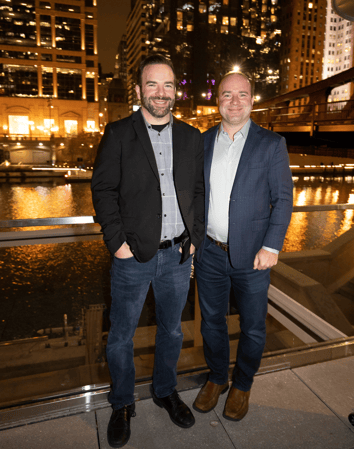

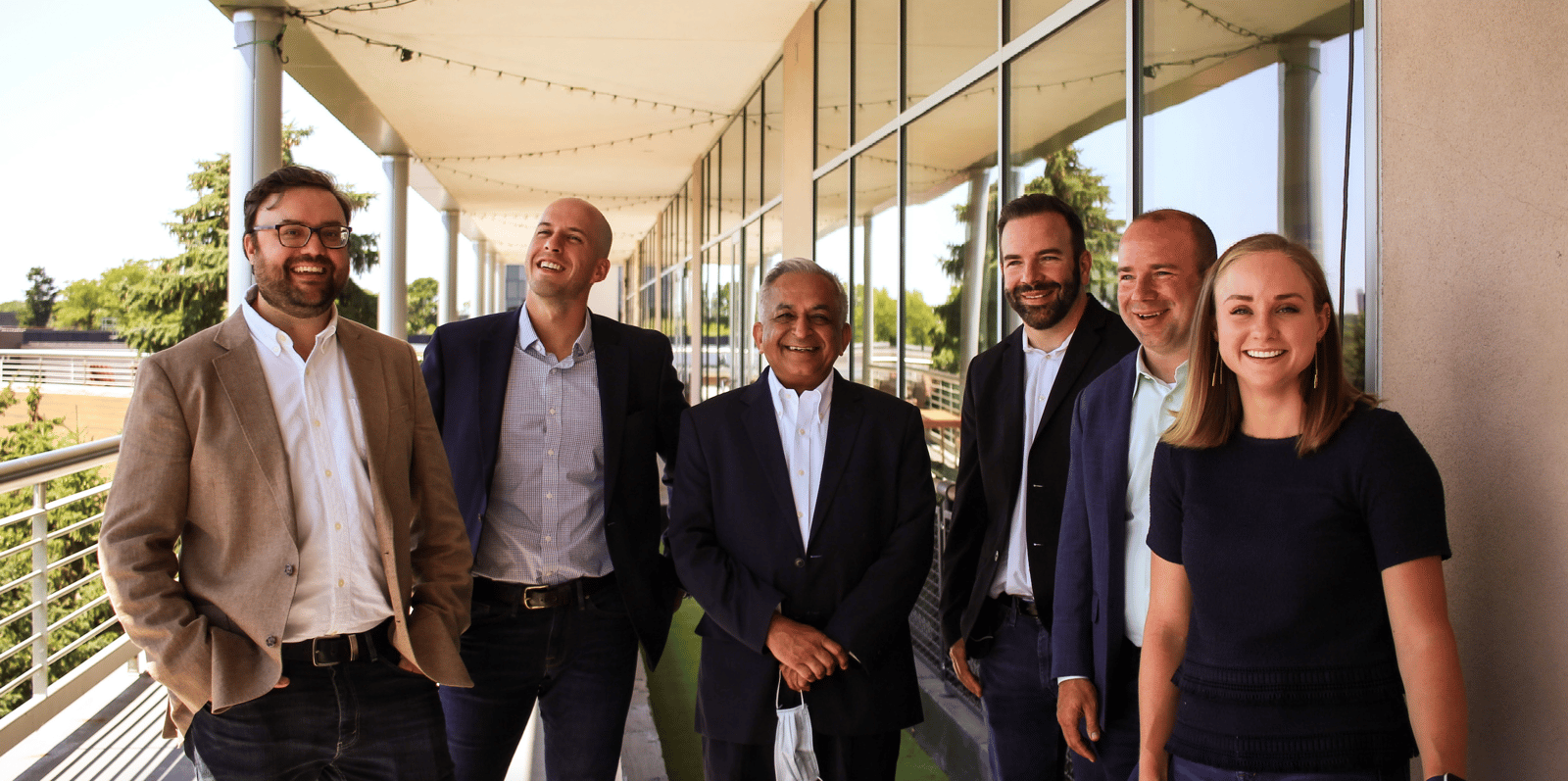

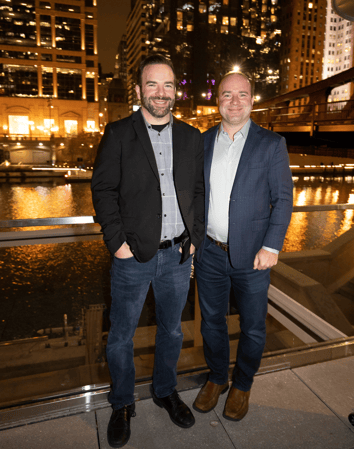

Great North Ventures invests in people.  Since 2006, the founders have invested in over 60 startups. The company has over 50 advisors who are involved in the fund, with names and corporate connections of the likes of Google, Pinterest, Target, and Walmart to name a few. While this type of “founders club,” is common practice in Silicon Valley, Minnesota didn’t have the same infrastructure to support high-level entrepreneurial ambition. Until Great North Ventures. As an early-stage venture fund, the Minnesota-based company specializes in seed-stage companies on the cusp of actualizing dreams of becoming thriving businesses. For brothers and founders Ryan and Rob Weber, Central Minnesota is a community rich with opportunity for startups and entrepreneurial development. The company is headquartered in St. Cloud and both Webers are SCSU alumni. The company’s first fund raised $23.7 million and its second fund should close late this spring.

Since 2006, the founders have invested in over 60 startups. The company has over 50 advisors who are involved in the fund, with names and corporate connections of the likes of Google, Pinterest, Target, and Walmart to name a few. While this type of “founders club,” is common practice in Silicon Valley, Minnesota didn’t have the same infrastructure to support high-level entrepreneurial ambition. Until Great North Ventures. As an early-stage venture fund, the Minnesota-based company specializes in seed-stage companies on the cusp of actualizing dreams of becoming thriving businesses. For brothers and founders Ryan and Rob Weber, Central Minnesota is a community rich with opportunity for startups and entrepreneurial development. The company is headquartered in St. Cloud and both Webers are SCSU alumni. The company’s first fund raised $23.7 million and its second fund should close late this spring.

What Venture Capital Firms Do

Venture capital is a form of funding that connects entrepreneurs with the funding necessary to fuel growth and connects investors to high-growth business opportunities. It is typically used to fund tech or tech-enabled businesses that can scale quickly. Great North Ventures focuses on tech startups within three types of innovation: market innovation, technology innovation, and user-driven innovation. For market innovation it focuses on startups working to relieve the pressure placed upon commerce and economy by labor shortages; for tech innovation, it focuses on startups using AI (artificial intelligence) to digitally transform enterprise or consumer markets through automation improvement; and lastly, for user-driven innovation, it focuses on social networks that improve user experience and streamline necessary communication between users in a market. “We like to say we’re Minnesota first,” explains Ryan Weber, Managing Partner and Co-Founder. “We can invest anywhere, but we’re choosing to invest in startups based in the upper midwest. We focus primarily on industries that are prevalent in the areas we serve.” “We’ve been very passionate about entrepreneurial startups in underserved communities, notably those of female or minority-led initiatives. There’s a huge gap in greater Minnesota of startups receiving investment capital. It’s important to us to develop a strong ecosystem of startup innovation because all industries need to learn to adapt to the ever-increasing pace of new technologies,” he said.

The Long Game

“We donated $300k and 1,800 hours in our first three years of running the fund to support entrepreneurship capacity in the region. This is about investing in our community and the startup spirit that’s very much alive here. We really want to get entrepreneurs involved in driving innovation in our region and telling that story themselves,” Weber said. He continued, “Per capita, we are not producing the number of startups we should be. This is where a lot of the economic opportunity exists. We need to develop more adaptive organizations both mid-to-large cap companies. It’s not going to change overnight. It’s going to take 10 years to see how these efforts influence the community fully. I feel like we could do so much more and with growing interest and support it feels like we’re on the right track..”

Assets Aplenty

“There are advantages and disadvantages to every ecosystem and community. I was raised in the Twin Cities metro, but have been in St. Cloud since 1998. I studied here. I started my family here. I grew and scaled our first company here. I’ve worked out of the Metro and Silicon Valley alike and the thing that stands out the most to me in a city like St. Cloud is the community’s support. I have always felt included and I felt like I was always welcome even though I didn’t grow up here, and I didn’t have a network here,” Weber said.  From a talent perspective, Weber acknowledged that the population here is young, with a high student population. He explained, “I think it’s an asset to have the university systems we do. I do not think there’s a comparable market in terms of raw technical talent, relative to the moderate number of local employees filling such jobs, in the rest of the state. From a family standpoint, I enjoy the relative closeness of the Twin Cities Metro. We can do our weekends at sporting events, entertainment, and the airport. In terms of St. Cloud itself, we have great schools, healthcare systems, and places like GREAT Theatre and the Mississippi River. And, as someone who grew up in the Cities, I never worry about traffic here!” Weber said. When asked about what people might be surprised to learn about Great North Ventures, Weber said, “I think people might tend to think of tech and startups as a distant thing. It’s here. Here in Central Minnesota, there are many people working on interesting, innovative products and technology. You don’t have to go very far to find the people using new technology. People who have had these experiences can be good connectors and mentors. Take ILT Academy, for example. That’s a perfect example of collaboration and capital efforts designed to bring outstate Minnesota the interesting opportunity we need. It’s right here in our backyards in St. Cloud.”

From a talent perspective, Weber acknowledged that the population here is young, with a high student population. He explained, “I think it’s an asset to have the university systems we do. I do not think there’s a comparable market in terms of raw technical talent, relative to the moderate number of local employees filling such jobs, in the rest of the state. From a family standpoint, I enjoy the relative closeness of the Twin Cities Metro. We can do our weekends at sporting events, entertainment, and the airport. In terms of St. Cloud itself, we have great schools, healthcare systems, and places like GREAT Theatre and the Mississippi River. And, as someone who grew up in the Cities, I never worry about traffic here!” Weber said. When asked about what people might be surprised to learn about Great North Ventures, Weber said, “I think people might tend to think of tech and startups as a distant thing. It’s here. Here in Central Minnesota, there are many people working on interesting, innovative products and technology. You don’t have to go very far to find the people using new technology. People who have had these experiences can be good connectors and mentors. Take ILT Academy, for example. That’s a perfect example of collaboration and capital efforts designed to bring outstate Minnesota the interesting opportunity we need. It’s right here in our backyards in St. Cloud.”

Since 2006, the founders have invested in over 60 startups.

Since 2006, the founders have invested in over 60 startups. From a talent perspective, Weber acknowledged that the population here is young, with a high student population. He explained, “I think it’s an asset to have the

From a talent perspective, Weber acknowledged that the population here is young, with a high student population. He explained, “I think it’s an asset to have the